Long Trades and Short Trades

Triston Martin

Nov 02, 2022

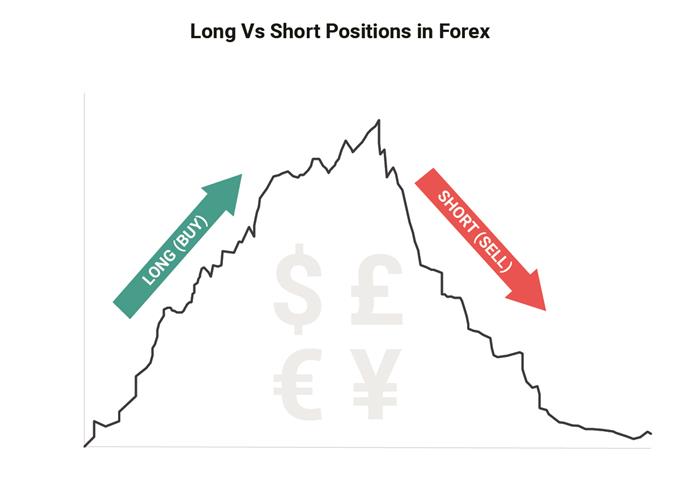

Long trades are those conducted to profit from increases in the price of an asset. Short trades are transactions conducted to profit from a decline in the price of a security. Short trades include borrowing share to sell now, then buying back later, with the expectation of doing so at a lower price than the original sale. On the other hand, long trades involve purchasing shares with the intention of later selling them for a profit.

How to Conclude the Business Transaction

Both long trades and short trades entail the purchasing and selling of an asset; however, the processes involved in carrying out each sort of transaction are somewhat distinct from one another. When an investor holds onto an investment for an extended period, they utilize a common strategy among investors. You purchase security with the intention of holding onto it for a long time, expecting its price to rise during that time. You plan to sell the security later, with the expectation of making a profit.

In contrast, shorting entails selling a security before you ever buy it. Before beginning a short trade, you must first borrow shares from another party, who will most often be your broker. After that, you put those shares up for sale on the market. You will be given cash from the sale, but you will still be responsible for repaying whoever loaned you the shares.

After some time has passed, you will be required to purchase the shares you borrowed and then give them back to the lender to satisfy your financial obligation. You have successfully finished the short transaction when you do this. In an ideal scenario, you will be able to purchase the shares at a lower price than you got when selling the shares you had borrowed. This will enable you to retain the difference as a profit.

How to Make Money

The most significant distinction between the two is how long and short trades create profit. Profits may be made in long trades by anticipating that the underlying security's price will go up. Profits may be made in short trades by anticipating the underlying securities' price will fall.

If you wish to make a long-term investment in XYZ company, you might acquire 100 shares at $50 each for a total investment of $5,000 (100 times $50). If XYZ achieves a price of $55 per share, the value of the shares you already possess will increase to $5,500 (100 shares times $55). If you were to sell, the deal would result in a profit of $500 ($5,500 minus $5,000). If XYZ dropped to $45 a share, the value of your 100 shares would be $4,500 (100 times $45), and you would incur a $500.

If you sell XYZ stock short, your broker would need to lend you 100 shares. Now let's say you sell shares for $50. In return for those shares, you would be given a total of $5,000 (100 times $50) if that were the case. However, you are not the owner of those shares of stock. You would have to purchase 100 shares if you wanted to return the shares to your broker.

If the share price of XYZ falls to $45 per share, you will be able to purchase the 100 shares for $4,500 (100 times $45 each). Your profit would be $500, given that you only spent $4,500 but received $5,000 thanks to the deal. However, if the price of XYZ stock increases to $55 a share, you will need to spend $5,500 (100 times $55) to buy 100 shares. Because you will spend more money on the trade than you make from it, you will come out $500 worse off.

Risk

It is of the utmost importance to have a thorough understanding of the disparity in risk that exists between long trades and short trades. When taking long positions, there is less potential for loss. If you invest $20 in a share of stock, the worst-case scenario is that its price will drop to zero, and you will lose that whole $20 investment. Since the price cannot go below zero, your whole stake is at risk equal to the amount you initially deposited.

When you sell securities short, you expose yourself to a limitless potential danger. At some point in the future, you will need to buy back the stock that you had previously sold short. The price of a share of stock may go as high as the market will bear it. When you short-sell a share for $20, it has the potential to grow to $40, $100, $100,000, or even more, which means that you run a far greater risk of incurring losses via short trades than through long trades.